Along with casting votes for President and US Senator, Wisconsin voters across the state will have school referenda to consider. These referenda ask voters’ permission to issue debt for something specific or to exceed the annual revenue limits set by state law, in either case by increasing voters’ property taxes. Voters typically hear from their school districts about what the expenses are needed for, but specific information about what that would mean to their taxes might be buried, or not explained at all. To help alleviate that, WILL has created the referendum cost calculator above.

WILL Senior Research Analyst, Noah Diekemper, remarked, “WILL is helping voters make an educated decision about the upcoming referenda on the November ballot. In this work, we discovered some major transparency issues with how local governments communicate with their constituents. It has become very clear to us that more work needs to be done to protect taxpayers.”

This calculator provides an estimate of what new school spending could do to property taxes in your area. It includes estimates for 111 of the 121 school districts that are voting on referenda this November 5. For the remaining 10, the relevant information could not be found online and was not provided in response to open records requests. This calculator (and the underlying data) does have some important limitations and caveats, discussed throughout and enumerated at the end of this post.

Takeaways from Calculator

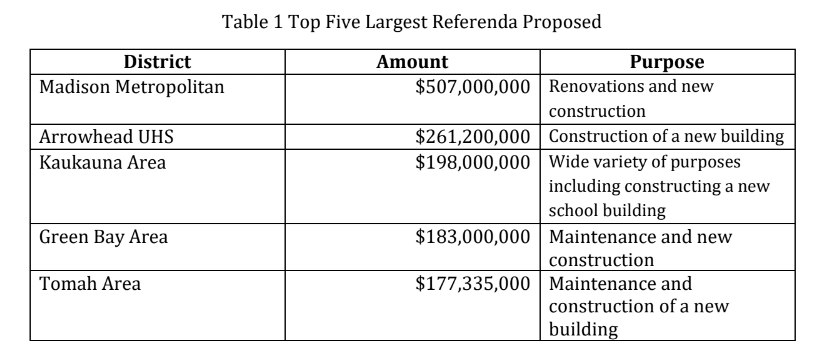

This November, school district referenda are putting a grand total of $4,284,530,513.00 on the ballot. The top five most expensive referenda that are being voted on, which account for nearly a third of the total money at stake, are highlighted in Table 1. By far the largest single referendum is in Madison, with taxpayers being asked to increase their taxes by $500 million—that amounts to more than 10% of the total money being asked for statewide. Perhaps the most staggering proposition, though, is the Arrowhead School District’s. Arrowhead is a high school-only district with just 2,038 students according to the most recent DPI data. This proposed debt would amount to about $128,164 per student.

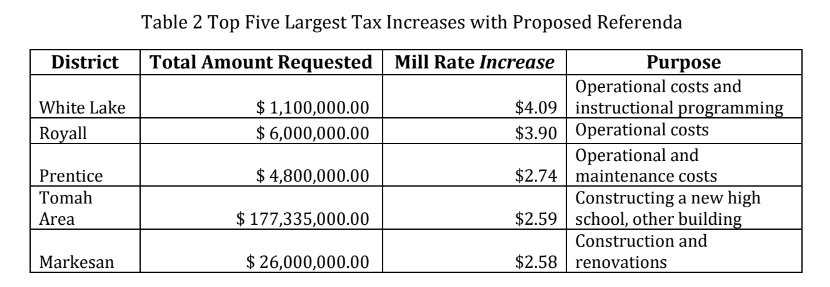

Of course, absolute costs are different from tax increases. We also look at the 5 biggest proposed property tax increases, computed as the difference between the tax rate that would result if the referendum passes versus the tax rate if it does not pass. This property tax is typically expressed as a “mill rate.” (A mill rate is the amount of money per $1,000 of property value that is taxed for school district purposes each year.) The top five largest property tax increases are highlighted in the table below. Tomah Area is the only one to appear on both top 5 lists, thanks to its proposal to acquire land and build a new high school campus on it, in addition to converting existing buildings (the current high school will be turned into a middle school, etc.). Note that computing these increases is subject to the same data limitation described below, i.e., where a school district does not have a specific mill rate planned for if their referendum fails, we use the current mill rate.

Frivolous Spending?

At least eight of the referenda include the word “athletic,” suggesting a purpose of the referendum is something beyond the core academic functions of the school district. Unsurprisingly, this figures into the referendum in Arrowhead, whose ballot proposition mentions “construction of a new high school building, including an auditorium and pool” and “athletic facility and site improvements.” Others are described in such an ambiguous way that it’s difficult to gain any understanding of what the district plans to do with the money. For example, the description of a referendum in Ithaca is as follows:

“Resolution providing for a referendum election on the question of the approval of a resolution authorizing the school district budget to exceed revenue limit by $1,300,000 per year for four years for non-recurring purposes.” What those “purposes” are is apparently left completely to the imagination of district leadership.

2024 Referenda in Context

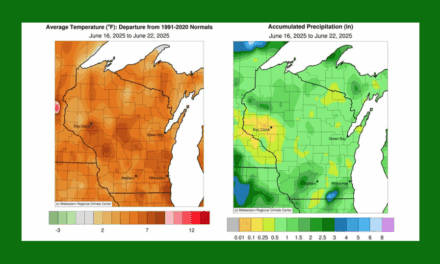

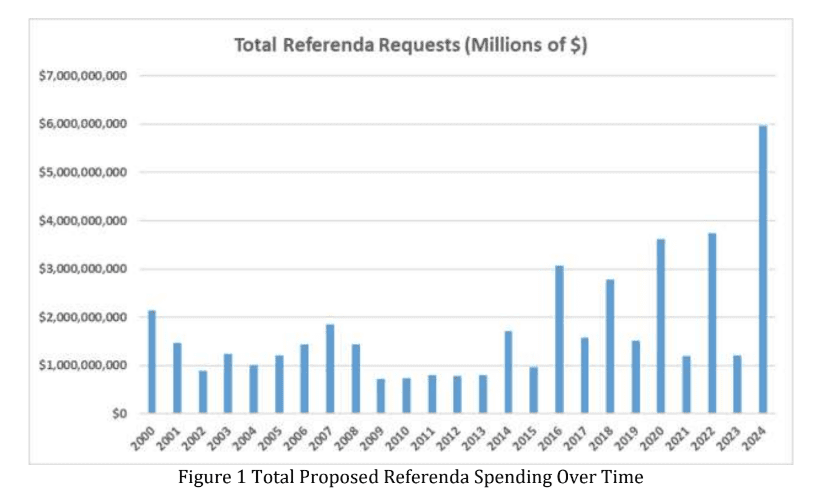

Figure 1 depicts the amount of money requested by school districts in referenda every year since 2000. The numbers are all inflation-adjusted to current-day levels. 2024 is by far the highest bar on this chart, with nearly $6 billion in new referenda spending proposed between the Spring and Fall election cycles. This dwarfs the second highest year—2022—by more than $2.2 billion.

School districts continue to rationalize the need for so many referenda with the claim that spending has not kept up with inflation. But this is only true if you look at spending in 2009 to 2011 as the baseline. Those years brought a massive infusion of federal money following the Great Recession. The reality is that we are spending more than at any other point in our state’s history according to data from the Department of Education. Voters have the right to raise their education spending through the referendum process. But they also ought to ask: when is enough enough?

Wisconsin Institute for Law and Liberty