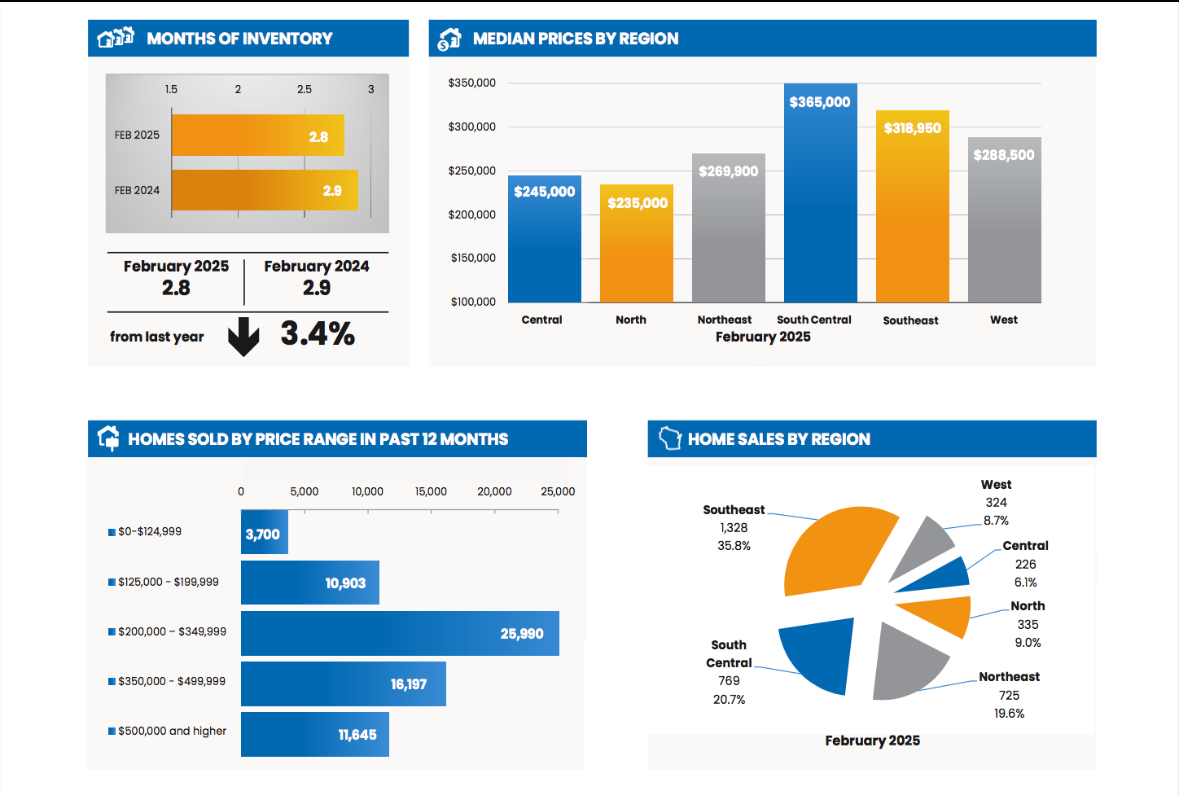

According to the Monthly Housing Report issued by the Wisconsin REALTORS® Association, Wisconsin existing home sales rebounded in February after modest growth in January. February home sales increased 7.0% compared to that same month in 2024, which is more than three times the rate of growth in January. Inventories tightened, which put strong pressure on prices. The median price increased to $304,900, which is a 10.9% increase over the last 12 months.

“There continues to be significant unmet millennial demand for housing, and unfortunately these buyers face significant headwinds with rising prices and high mortgage rates taking a toll on affordability. Given the weakness in inventories, we can expect strong price pressure for the foreseeable future. Hopefully mortgage rates moderate this spring to improve affordability.”

Tom Larson, President & CEO, Wisconsin REALTORS® Association

- Year-to-date sales rose 4.4% compared to the first two months of 2024, and the median price rose 11.1% to $300,000 over that same period.

- After continuous improvement over the past two years, months of available supply weakened slightly, from 2.9 months in February 2024 to 2.8 months in February 2025. Moreover, months of inventory fell in five of the six regions of the state, with the only exception being the North region, which saw moderate improvement.

- With total listings just over 16,000 homes in February, listings would need to increase 113% to reach the six-month benchmark that signals a balanced market.

- Although total listings were flat over the past 12 months, new listings of homes dropped 12.2% over that same period.

- Mortgage rates remained high. The average 30-year fixed mortgage rate was 6.84% in February, only slightly higher than the February 2024 average of 6.78%.

- High mortgage rates and high housing prices have created a persistent affordability problem. The Wisconsin Housing Affordability Index measures the percent of the median-priced home that a typical buyer with median family income qualifies to purchase, assuming 20% down and the remaining balance financed with a 30-year fixed mortgage at current rates. The index stood at 125 in February. This is down from 139 in February 2024, which is a 10.1% reduction in affordability.

About the WRA

The Wisconsin REALTORS® Association is one of the largest trade associations in the state, representing over 17,500 real estate brokers, salespeople and affiliates statewide. All county figures on sales volume and median prices are compiled by the Wisconsin REALTORS® Association and are not seasonally adjusted. Median prices are only computed if the county recorded at least 10 home sales in the quarter. All data collected by the WRA is subject to revision if more complete data becomes available. Beginning in June 2018, all historical sales volume and median price data from 2015 forward at the county level have been re-benchmarked using the Relitix system that accesses MLS data directly and in real-time. Data prior to January 2015 is derived from the Techmark system that also accessed MLS data directly. The Wisconsin Housing Affordability Index is updated monthly with the most recent data on median housing prices, mortgage rates and estimated median family income data for Wisconsin. Data on state foreclosure activity is compiled by Dr. Russ Kashian at the University of Wisconsin-Whitewater.