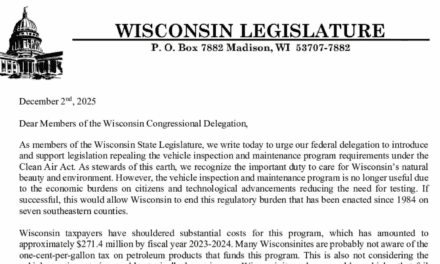

MADISON, Wis. — A conservative Wisconsin policy group is pressing Gov. Tony Evers to opt into a new federal scholarship program created by recent tax legislation signed by President Donald Trump, arguing it would expand educational opportunities for families at no cost to the state. The Wisconsin Institute for Law & Liberty (WILL) outlined the potential in a report released Monday, emphasizing that the program, part of the One Big Beautiful Bill Act (H.R. 1), could empower parents with flexible funding for their children’s education.

The federal law establishes the nation’s first tax credit scholarship program for K-12 students, offering donors a dollar-for-dollar federal tax credit of up to $1,700 for contributions to certified Scholarship Granting Organizations (SGOs) starting in 2027. These nonprofits award scholarships for expenses like private school tuition, tutoring, transportation, internet access, technology, materials, and therapies for students with special needs, benefiting families across public, charter, private, and homeschool settings. To participate, Evers must submit a list of qualified SGOs to the U.S. Treasury Department by Jan. 1, 2027, a simple step WILL says could unlock significant support.

“This new federal program offers a meaningful way to expand educational opportunity for Wisconsin students – at no cost to the state,” said Cory Brewer, WILL’s education counsel. “Whether it’s tuition, tutoring, or therapy, families should have every tool to help their kids succeed. We would like to see Governor Evers act so that Wisconsin families don’t miss out.” Read the full report here.

Wisconsin risks losing out, as residents could donate to SGOs in other states, diverting tax credit benefits elsewhere, the report warns.

Wisconsin’s pioneering role in school choice, dating back to the 1990 Milwaukee Parental Choice Program, underscores the stakes. As the nation’s first urban voucher initiative, it set a precedent for empowering parents to choose schools that best fit their children’s needs. Wisconsin Parental Choice Program, which includes all areas of the state other than Milwaukee and Racine, both of which have their own programs. The state Choice Program grew last year to 21,638 students, 12.8% over the 2023 enrollment. Milwaukee Parental Choice Program saw enrollment grow by 2.6% to 29,732 students. The Racine Parental Choice Program increased their enrollment to 4,185 students, an increase of 3.6%.

This enthusiasm reflects tangible outcomes. As reported earlier this week, a new report from School Choice Wisconsin confirms that Wisconsin’s private school choice programs outperform traditional public schools while operating with substantially less funding.

“DPI gives choice schools higher Report Card scores even though they receive substantially less revenue,” said Brenda White, chair, School Choice Wisconsin Board of Directors. “School choice is Wisconsin’s most cost‑effective K‑12 investment.”

The report draws on official Wisconsin Department of Public Instruction data for the 2023–24 school year, the first after a “significant funding increase approved by the Legislature and Governor for PSCP schools.” Even after a 23 percent average funding boost, private school choice programs still receive substantially less per‑pupil revenue than public schools, yet they continue to post higher DPI Report Card scores .

State test data from 2024 indicates choice students outperform public school peers in proficiency, despite receiving only a fraction of per-pupil public funding. The federal program could amplify this success by offering flexible scholarships to cover not just tuition but also critical supports like tutoring or special needs services, further enabling parents to tailor education to their children’s unique needs.

The program’s design, fully funded by private donations incentivized by federal tax credits, ensures no strain on Wisconsin’s budget. Eligibility, set at 300% of area median income—about $306,300 for a family of four in Milwaukee County—extends access to more middle-class families than state programs, which cap at lower income thresholds. Critics, including the NEA, have argued for decades that school choice diverts resources from public schools.

Spending on public schools continues to increase even as School Choice programs gain in popularity.

The One Big Beautiful Bill Act, signed July 4, includes permanent tax cuts, a doubled standard deduction, and the scholarship credit with no nationwide cap on total credits. SGOs must serve at least 10 students across multiple schools and allocate 90% of funds to scholarships, prioritizing returning recipients. The U.S. Education Department will set operational rules.

U.S. Sen. Tim Scott, R-S.C., praised the credit as a step toward nationwide, universal, school choice, while Education Secretary Linda McMahon called it a win for families.

In Wisconsin, where school choice is a proven and popular part of the educational landscape, the federal program could build on a legacy of innovation, provided Evers acts to join.

Published Aug. 13, 2025

Previously at Dairyland Sentinel