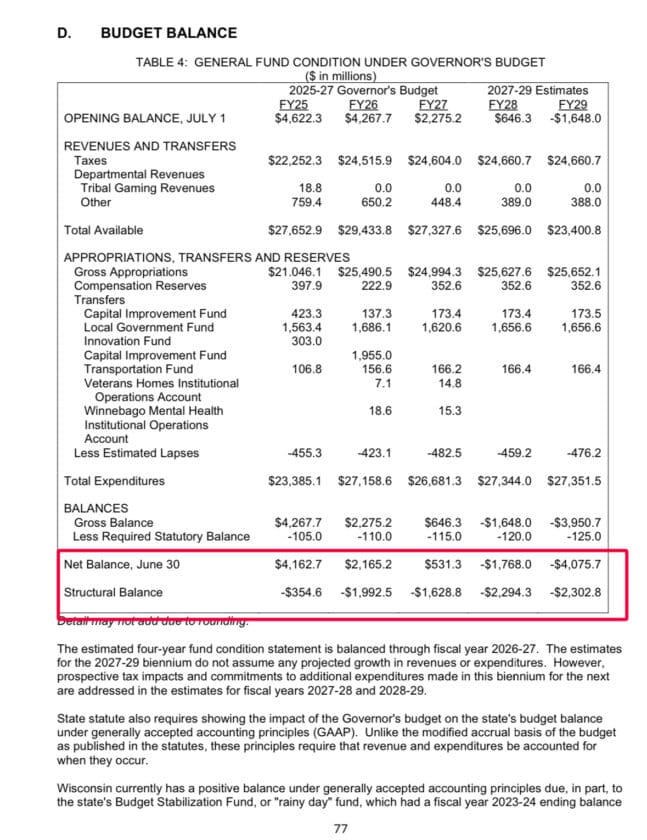

All charts and text below are directly from the Budget in Brief published by the Department of Administration

By the Numbers

TAX HIKES

…creating a new individual income tax bracket with a marginal rate of 9.8 percent on taxable income above $1 million for single and married-joint filers and $500,000 for married-separate filers beginning with tax year. The fiscal impact is an estimated increase in tax revenue of $719.3 million in fiscal year 2025-26 and $578.4 million in fiscal year 2026-27. PAGE 26

Limit the amount of qualified production activities income that may be claimed by manufacturing firms under the manufacturing and agriculture credit to $300,000 per tax year. …The fiscal impact is an estimated increase in tax revenue of $418.5 million in fiscal year 2025-26 and $373.8 million in fiscal year 2026-27. PAGE 26

Amend state statutes to conform with major changes made to the federal Internal Revenue Code from the Tax Cuts and Jobs Act of 2017. The net fiscal impact of these changes is an increase in tax revenue of $237.4 million in fiscal year 2025-26 and $250.4 million in fiscal year 2026-27 PAGES 26 and 27

REPEAL OF ACT 10 REFORMS

- Establish collective bargaining rights for state and local government front-line workers, including University of Wisconsin System faculty, academic staff, and graduate assistants, and their bargaining units. Front-line workers are defined as employees with a substantial portion of job duties interacting with members of the public or large populations or directly involve maintenance of public works. The Employment Relations Commission will settle definitional disputes.

- Expand collective bargaining rights for municipal and state public safety workers, transit employees, and front-line workers to allow collective bargaining over the employer-paid share of health insurance premiums.

- Eliminate the annual recertification requirement for state and local government bargaining units, as well as the provision that approval by a majority of bargaining unit members, instead of majority of the vote, is required to certify.

- Require employers to meet at least quarterly, or upon a change in policies affecting wages, hours, and working conditions of general employees, with certified representatives of collective bargaining units, if applicable, or with other representatives in order to receive employee input.

- Provide 17.5 FTE GPR positions at the Employment Relations Commission and 20.0 FTE PR-S positions at the Division of Personnel Management within the Wisconsin Department of Administration in fiscal year 2026-27 to assist employees, bargaining units, and units of government with the expansion of collective bargaining rights. Positions to support the expansion of collective bargaining rights have been created at both agencies and will be funded through federal ARPA funds through December 31, 2026.

- Require local government employers to include a just cause standard of review of termination in their grievance procedures. Additionally, require existing local government grievance procedures to address employee discipline and workplace safety issues.

- Improve Wisconsin’s workforce and pipeline with experienced professionals by authorizing state agencies and local units of government, including schools, to rehire a retired annuitant to address workforce recruitment and retention issues, if: (a) at least 30 days have passed since the employee left employment; (b) at the time of retirement, the employee does not have an

agreement to return to employment; and (c) upon returning to work, the employee elects to not become a participating employee and continue receiving their annuity. PAGE 25

State Employee Pay Hikes

- Provide funding in the compensation reserve, and any statutory language changes needed for the following items to make investments in the state government’s workforce, address recruitment and retention challenges in key state positions, and ensure the state can be a competitive employer. The state’s compensation plan will also have to be approved by the Joint Committee on Employment Relations.

- Provide $372.5 million GPR over the biennium for a general wage adjustment for most state employees of 5 percent on July 1, 2025, and an additional 4 percent on July 1, 2026.

- Provide $10.9 million GPR over the biennium for targeted market adjustments for employees within certain classifications in state agencies to better align their wages to those paid by private and other public sector employers.

- Provide $5.3 million GPR over the biennium to support the development of pay progressions for several targeted classifications that will allow employees to increase pay based on performance and experience.

- Provide $9.6 million GPR over the biennium to strengthen the pay progression for probation and parole agents within the Wisconsin Department of Corrections and to provide parity adjustments to supervisory positions.

- Provide $4.3 million GPR over the biennium to continue the $5 per hour add-on for all hours worked by correctional officer staff at the Waupun Correctional Institution.

- Provide $3.8 million GPR over the biennium to develop and implement a state employment apprenticeship program administered by the Wisconsin Department of Administration.

- Provide $7.4 million GPR in fiscal year 2026-27 to support a new paid family and medical leave program for state and University of Wisconsin System employees for eight weeks annually, effective January 1, 2027.

- Decrease the waiting period for all new state employees to receive the employer share of their health insurance premiums from three months to two months.

- Fund paid sick leave for limited term employees that work for state agencies and temporary employees that work for the University of Wisconsin System.

- Modify the vacation allowance during the first five years of state employment to improve retention of employees for state agencies.

- Establish Juneteenth and Veterans Day as state government holidays.

- Provide funding in new appropriations to support the supplementation of state agency appropriations for costs associated with general wage adjustments provided to employees performing enterprise services at the Wisconsin Department of Administration and incurred by state agencies through enterprise assessments and billings. PAGES 25 and 26