UPDATE: Fiserv Announces Updates to Leadership Team and Board “Refreshment” (Link to Company Statement)

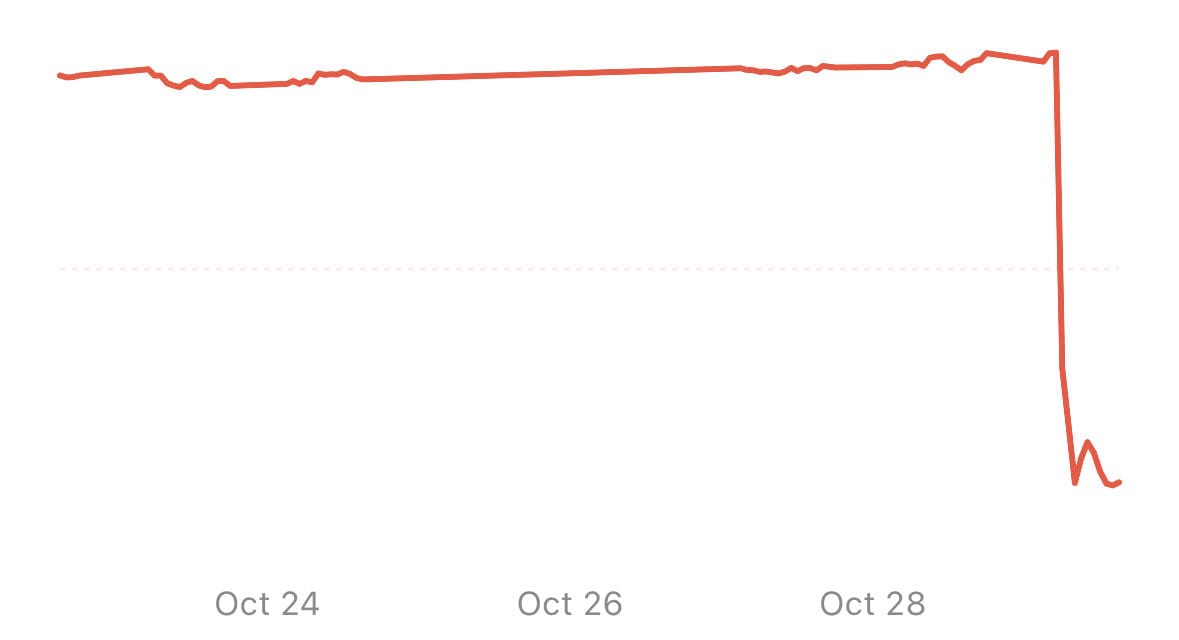

MILWAUKEE — Shares of Fiserv, Inc. (ticker FI) tumbled roughly 42 % Wednesday, marking their steepest one-day drop on record, after the company dramatically lowered its full-year outlook and reported weak third-quarter results.

Bad day, worse year

Shares opened around $69 and closed near $70, down from about $126 just prior to the earnings release. Reuters noted the 52-week range hits as low as $66.59. Over the year to date, Fiserv is now among the worst-performing stocks in the S&P 500 as sentiment shifted sharply.

What went wrong

In its Q3 release, Fiserv reported adjusted earnings of $2.04 per share, missing expectations of roughly $2.64. Revenue of about $4.9 billion likewise fell short. The company subsequently lowered its 2025 organic revenue growth guidance to 3.5 %–4 %, down from prior expectations of around 10 %. Adjusted EPS for the year was revised to $8.50–$8.60, down from over $10 per share.

One analyst at Jefferies characterized the reset as “difficult to comprehend.”

Another from Truist said: “To be frank, we are struggling to recall a miss and guide down to this degree in any of the sub-sectors we have covered during our time on the street.”

Management told industry press that weaker growth in Argentina and delayed investments as contributors to the miss and the new strategy.

Wisconsin roots remain

Based in Milwaukee, Fiserv has strong regional ties. The company relocated its global headquarters from Brookfield to downtown Milwaukee in March 2024, occupying a 170,000-square-foot facility at 600 N. Vel R. Phillips Ave.

Earlier, in 2022, the move was announced as part of a plan to bring 800 jobs downtown.

Strategic context

While Fiserv remains a major player in payments and financial-services technology, the sharp guidance cut and leadership shake-up raise serious questions about execution. The company has pursued acquisitions to expand its merchant-processing business, including its landmark 2019 acquisition of First Data Corporation and subsequent geographic expansion. Industry sources suggest the integration, elevated competition and slowing growth in key geographies have weighed on performance.

What it means going forward

For investors in Wisconsin and beyond, Fiserv’s plunge highlights the risk inherent in growth-dependent tech-enabled financial firms when expectations sour. Some analysts still see long-term value in the franchise, but caution the company must rebuild credibility.

As one note put it:

“It is impossible to sugar-coat…”

With the company’s ticker to transition to Nasdaq and new leadership in place, the spotlight now shifts to whether Fiserv can execute its recovery plan.

For now, the stock’s dramatic drop and shaky outlook underscore how quickly the market can punish even established players. It is a shock not only to the market, but to the Wisconsin economy as locals begin to speculate the employment ramifications of the stock swoon.