WRA Issues Wisconsin Housing Report for November 2024

The inventory of available homes remains very tight even as solid demand conditions persist. The mismatch between supply and demand has limited sales growth and driven up home prices.

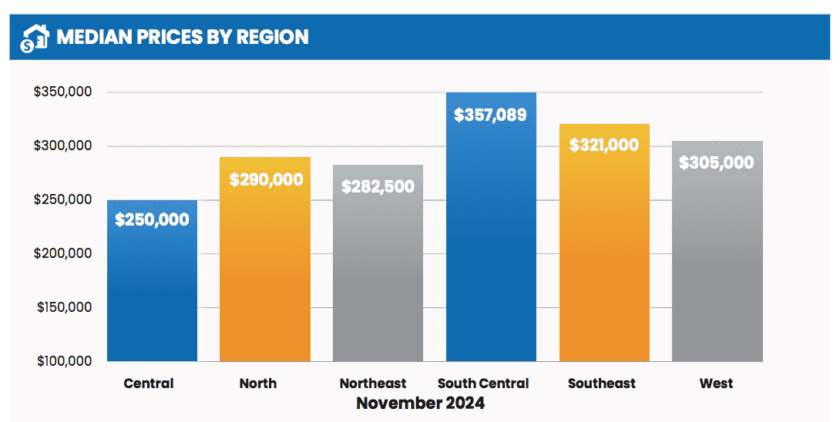

November existing home sales rose by a modest 1.7% compared to November 2023, and the median price rose 10.8% to $310,000 over that same 12-month period. On a year-to-date basis, home sales were up 4.1% compared to the January-through-November period in 2023, and the median price rose 8.8% to $310,000.

“Home sales are generally slower during the winter months, but there are some potential advantages to buying during this time of year. You will likely face less competition from other buyers, and as a result, you can expect more flexibility from sellers who are motivated to list their homes during this slower season for sales.”

Tom Larson, President & CEO, Wisconsin REALTORS® Association

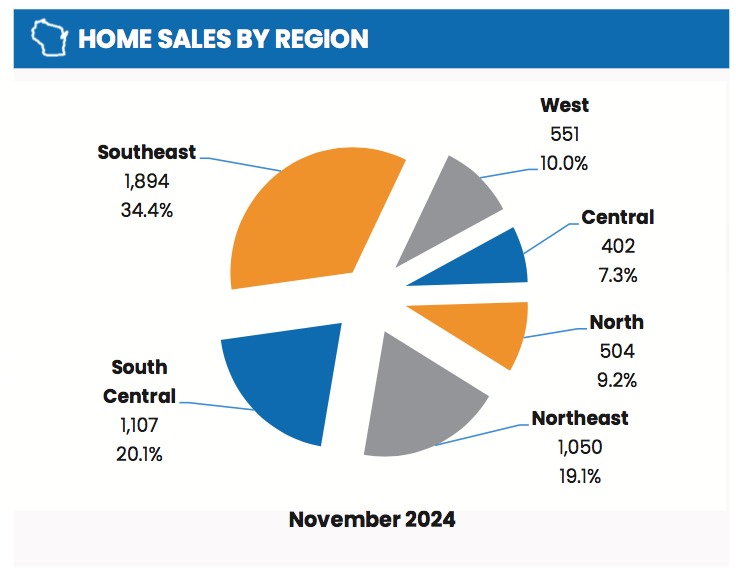

November sales varied across regions, with solid growth in the South Central region, up 6.9%, and the West, up 15.3%; relatively flat sales in the Central region, down 0.2%, and the Southeast, up 1.2%; and weaker sales in the Northeast, down 4.4%, and the North, down 5.1%. In contrast, year-to-date growth for 2024 was consistently positive across regions, ranging from 1.8% to 6.4%, compared to the first 11 months of last year.

Although there was improvement in total listings, which were up 7.9% compared to November 2023, the housing market remains a strong seller’s market, with just 3.3 months of available supply. This is well below the six-month benchmark that characterizes a balanced market.

Affordability remains a significant challenge, especially for first-time buyers who don’t have equity from the sale of an existing home to apply to a home purchase. Although 30-year fixed mortgage rates are more than a half percent lower than November 2023, they have been rising the last two months. The Wisconsin Housing Affordability Index shows the portion of the median-priced home that a buyer with median family income can purchase, assuming 20% down and the remaining balance financed with a 30-year fixed mortgage rate. The index fell 3.2% since November 2023.

About the WRA

The Wisconsin REALTORS® Association is one of the largest trade associations in the state, representing over 17,500 real estate brokers, salespeople and affiliates statewide. All county figures on sales volume and median prices are compiled by the Wisconsin REALTORS® Association and are not seasonally adjusted. Median prices are only computed if the county recorded at least 10 home sales in the quarter. All data collected by the WRA is subject to revision if more complete data becomes available. Beginning in June 2018, all historical sales volume and median price data from 2015 forward at the county level have been re-benchmarked using the Relitix system that accesses MLS data directly and in real-time. Data prior to January 2015 is derived from the Techmark system that also accessed MLS data directly. The Wisconsin Housing Affordability Index is updated monthly with the most recent data on median housing prices, mortgage rates and estimated median family income data for Wisconsin. Data on state foreclosure activity is compiled by Dr. Russ Kashian at the University of Wisconsin-Whitewater.

Note that the WRA employs a slightly different protocol to determine inventory levels than the protocol used by the REALTORS® Association of South Central Wisconsin (RASCW). For consistency, the summary tables for the South Central region reported in the WRA release employ the WRA approach. However, a modified table employing the RASCW methodology is available from the WRA upon request.