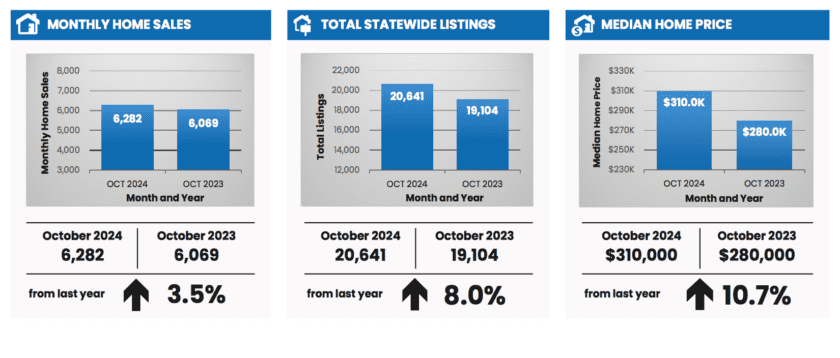

October 2024 at a glance

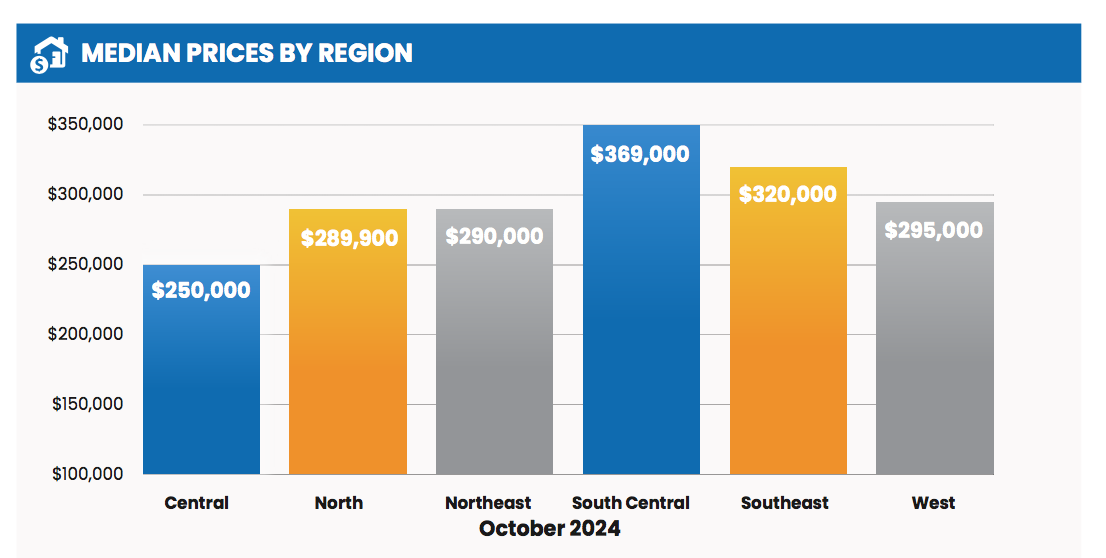

- October home sales rebounded after falling in September. Compared to October 2023, existing home sales rose 3.5%. Strong demand and tight supply continued to put upward pressure on the median price, which rose 10.7% to $310,000 over that same 12-month period. On a year-to-date basis, closed sales rose 4.1% relative to the first 10 months of 2023, and the median price rose 8% to $310,000.

- Inventories have improved due in part to the spike in listings recorded in October. New listings rose 8.6% compared to a year earlier, which pushed total listings up 8% over October 2023.

- Inventories improved across all urban-rural classifications, but they remain tightest in the state’s metropolitan counties, which had just 3.4 months of supply in October. In contrast, micropolitan counties, which include smaller cities and towns, had 4.2 months of supply, and counties classified as rural had 4.9 months of supply.

- The state remains a seller’s market and would have needed 12,720 additional listings in October to reach a balanced market characterized by six months of supply.

- After falling 88 basis points between May and September, the average 30-year fixed-rate mortgage reversed course and increased a quarter percent in October to 6.43%. Still, mortgage rates are more than a percent lower than October 2023 when the average rate was 7.62%.

- Although mortgage rates did improve over the last 12 months, the spike in median prices and the tepid growth in median family income over the last year led to very little improvement in affordability. The Wisconsin Housing Affordability Index rose just 1.6% since October 2023.

Wisconsin Housing Report October 2024

“We’ve had consistent improvement in our listings beginning in November of last year, and the uptick in both new listings and total listings in October was a good sign. Although months of inventory are tightest in our large cities, they are getting closer to being balanced in Wisconsin’s smaller urban areas and rural communities.”

Tom Larson

President & CEO, Wisconsin REALTORS® Association

The Wisconsin REALTORS® Association is one of the largest trade associations in the state, representing over 17,500 real estate brokers, salespeople and affiliates statewide. All county figures on sales volume and median prices are compiled by the Wisconsin REALTORS® Association and are not seasonally adjusted. Median prices are only computed if the county recorded at least 10 home sales in the quarter. All data collected by the WRA is subject to revision if more complete data becomes available. Beginning in June 2018, all historical sales volume and median price data from 2015 forward at the county level have been re-benchmarked using the Relitix system that accesses MLS data directly and in real-time. Data prior to January 2015 is derived from the Techmark system that also accessed MLS data directly. The Wisconsin Housing Affordability Index is updated monthly with the most recent data on median housing prices, mortgage rates and estimated median family income data for Wisconsin. Data on state foreclosure activity is compiled by Dr. Russ Kashian at the University of Wisconsin-Whitewater.

Note that the WRA employs a slightly different protocol to determine inventory levels than the protocol used by the REALTORS® Association of South Central Wisconsin (RASCW). For consistency, the summary tables for the South Central region reported in the WRA release employ the WRA approach. However, a modified table employing the RASCW methodology is available from the WRA upon request.